5 401k match calculator

Tax On A 401k Withdrawal After 65 Varies. A 401k is an employer-sponsored tax-advantaged retirement plan.

How Much Should I Have Saved In My 401k By Age

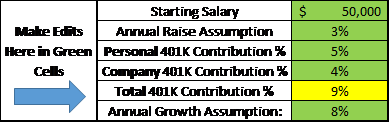

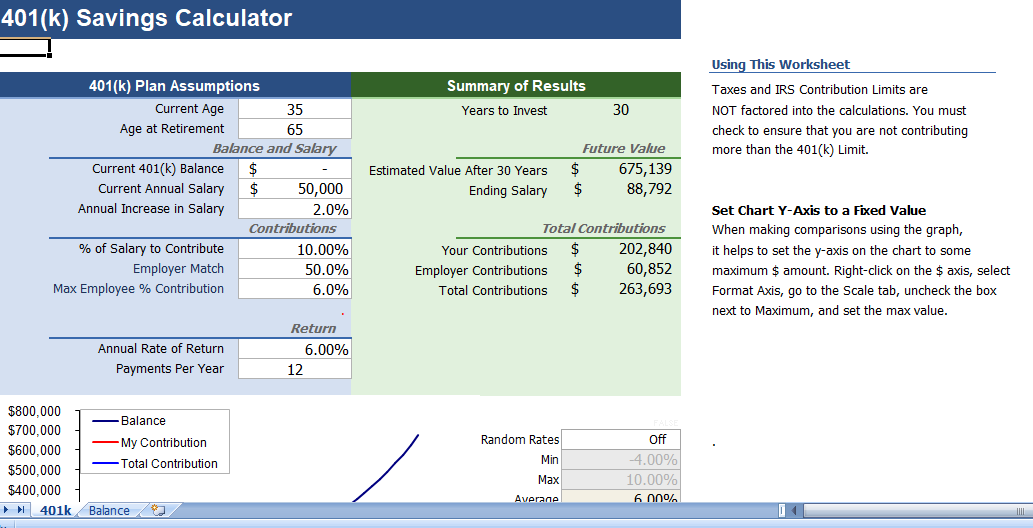

Based on your inputs we also make suggestions on how to increase your investment savings.

. Attract talent and match contributions so your team can grow with you. Free calculator to find the actual paycheck amount taken home after taxes and deductions from salary or to learn more about income tax in the US. Safe Harbor 401k Rules.

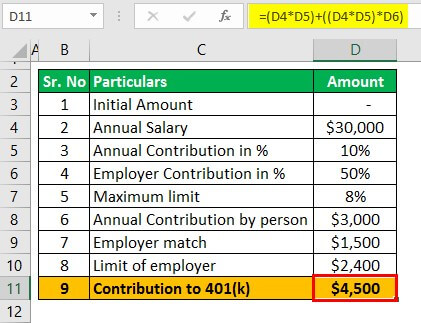

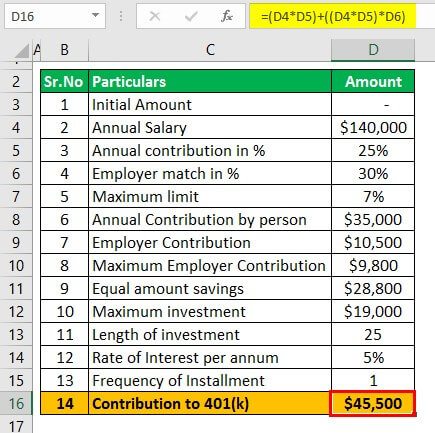

Simple 401k Calculator Terms Definitions 401k a tax-qualified defined-contribution pension account as defined in subsection 401k of the Internal Revenue Taxation Code. Step 6 Determine whether an employer is contributing to match the individuals contributionThat figure plus the value in step 1 will be the total contribution in the 401k Contribution account. The employer-matching funds will belong to you after five years at your job but if you leave your job after three years you will be 60 vested.

You can contribute 25 percent of your income up to a total contribution of 54000. Alternatives to Solo 401k. If you are receiving a match for example through an employer-based 401k it might be more attractive to pay into your retirement.

What Happens if I Leave Before I Am Fully Vested in My 401k. For instance in 2022 the 401k contribution limits rose 1000 from 2021 You start full-time employment at age 22 at a company that provides a 401k without a company match. Whatever you take out of your 401k account is taxable income just as a regular paycheck would be when you contributed to the 401k your contributions were pre-tax and so you are taxed on withdrawals.

Backward since the average 401k contribution limits were lower in the past. Including 401k the employees share of the health insurance premium health savings account HSA deductions child support payments union and uniform dues etc. Contribution Limits of an S-Corp 401k 7.

With a Safe Harbor Plan the employer can choose to contribute in one of three ways. Lets say you have a plan that increases the amount you are vested in your plan each year by 20this is known as graded vestingYou will be fully vested ie. Make sure that you talk to your administrator if you are contemplating a plan amendment.

0 4 10 3. You fund this account by contributing a set percentage of your paycheck into the account. Maximize employer 401k matching.

Glassdoor is your resource for information about the 401K Plan benefits at Target. The 72t rule is once completing a rollover and a 72t is setup to pay out an income stream it must continue until the age of 59 ½ has been reached or for a minimum of 5 years whichever comes last. Free 401K calculator to plan and estimate a 401K balance and payout amount in retirement or help with early withdrawals or maximizing employer match.

Access affordable 401k plans for small businesses with QuickBooks Payroll. If your employer offers a 401k match invest everything you. A safe harbor 401k plan will generally satisfy non-discrimination rules for both elective deferrals as well as employer matching contributions.

This calculator uses your input allocation percentages and rate-of-return for each to calculate a weighted-average rate-of-return for your net worth as it moves through the simulation. 0 4 10 0. Deadlines for Contributing to Your S-Corp 401k 10.

In this example you would enter 3 percent in the Match Up to field and 5 percent in the Additional Match Up to field to indicate the combined. Average 401k Returns Dont Tell the Whole Story. If the percentage is too high contributions may reach the IRS.

Inflation the rate at which the general level of prices for goods and services is rising and subsequently purchasing power is falling. However this number cant really tell you much. Investment Calculator is a beautifully simple calculator to help you calculate the potential value of your retirement investments and visualize their growth.

Step 5 Determine whether the contributions are made at the start or the end of the period. Pick the best retirement plan for your budget today. These accounts are 100 vested and must be funded on a per-pay-period basis.

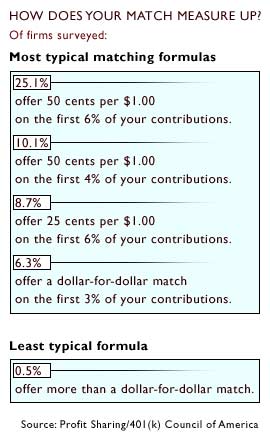

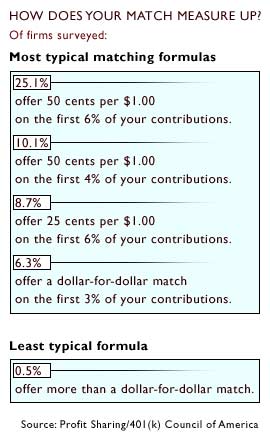

A case could be made for. You provide a mandatory match of 100 dollar for dollar on the first 3 of compensation contributed by employees plus a 50 match on the next 2 of compensation contributed by employees. Step 7 Use the formula discussed above to calculate the maturity amount of the 401k.

With this key job benefit your employer adds to the money you save boosting your 401k account over the long term. One of the biggest perks of a 401k plan is that employers have the option to match your contributions to your account up to a certain point. For example if you start a 72t at the age of.

Currently 5 per month for QuickBooks Online Payroll Core users for the QuickBooks Workers Comp Payment Service. Vanguards 2022 How America Saves report says the average 401k balance for Vanguard participants in 2021 was 141542 up 10 from the 2020 level. How To Calculate Required Minimum Distribution For An Ira.

Contribution percentages that are too low or too high may not take full advantage of employer matches. Learn about Target 401K Plan including a description from the employer and comments and ratings provided anonymously by current and former Target employees. A 401k match is money your employer contributes to your 401k.

On your Form 1040. Use the Additional Match fields if your employer offers a bi-level match such as 100 percent up to the first 3 percent of pay contributed and 50 percent of the next 2 percent of pay contributed. This debt repayment calculator figures how much faster you will get out of debt and how how much interest you will save by adding an additional principal repayment to your next regularly scheduled payment.

Solo 401k Calculator 9. The numbers are more forward-looking vs.

401 K Maximum Employee Contribution Limit 2022 20 500

The Maximum 401 K Contribution Limit For 2021

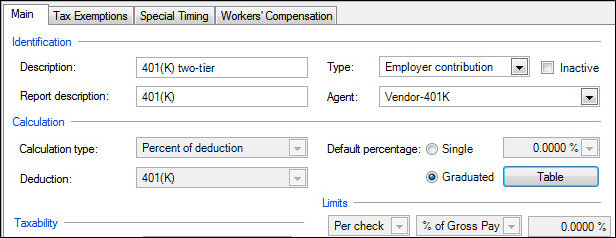

Employer Contributions Setup Examples Including A Graduated Table Example

Does Your Employer Penalize Aggressive Saving Odds Are Yes Resource Planning Group

This 401k Match Calculator Shows How Powerful Compound Interest Can Be

401k Calculator

The Maximum 401k Contribution Limit Financial Samurai

Customizable 401k Calculator And Retirement Analysis Template

401k Contribution Calculator Step By Step Guide With Examples

Employer 401 K Matching Everything You Need To Know Nextadvisor With Time

401k Calculator With Match Cheap Sale 59 Off Www Quadrantkindercentra Nl

I Created A Little Calculator To Figure Out Exactly What My 401k Contribution Election Should Be To Front Load It Early Each Year Reach The Annual Max And Still Get The Full

401k Calculator

401k Contribution Calculator Step By Step Guide With Examples

Doing The Math On Your 401 K Match Sep 29 2000

What Is A 401 K Match Onplane Financial Advisors

401k Calculator Excel Template For Free